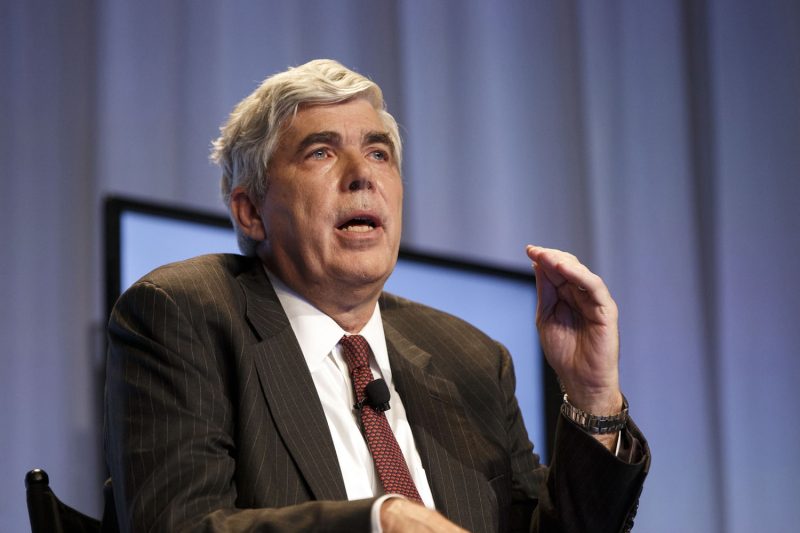

Kenneth Leech, the former co-chief investment officer of Western Asset Management Co, was charged by U.S. authorities on Monday with running a fraudulent “cherry-picking” scheme where he improperly favored some clients’ accounts over others when allocating trades.

The U.S. Securities and Exchange Commission said that between January 2021 and October 2023, Leech disproportionately allocated better performing trades to favored portfolios, and worse performing trades to other portfolios.

Leech also faces related criminal charges from the U.S. Attorney’s office in Manhattan, the SEC said.

Lawyers for Leech did not immediately respond to requests for comment. The U.S. attorney’s office did not immediately respond to a similar request.

Western Asset Management, known as Wamco, is part of Franklin Resources, which acquired the business through its purchase of Legg Mason in 2020.

Clients have pulled tens of billions of dollars from Wamco in the last few months, after Franklin announced that authorities were investigating Leech.